richmond county va business personal property tax

Business personal property taxes are assessed to business owners on all business vehicles office equipment computer equipment farm equipment small tools fixtures furniture merchants capital and manufacturing machinery tools located in. If you have questions about personal property tax or real estate tax contact your local tax office.

Finance Henrico County Virginia

July 1 September 30 50 of the full tax amount or 50 per 100 of net capital.

. Henricos personal property tax rate is. 2 days agoHenrico Countys Board of Supervisors approved an emergency ordinance that extends the due date for. Start Your Homeowner Search Today.

Richmond County Property Tax Bill Breakdown. Richmond County Va Business Personal Property TaxManufacturers do not pay tax on purchases used for production. View and print Information about Property Tax PDF in Richmond County.

Ad Find Richmond County Online Property Taxes Info From 2021. The 10 late payment penalty is applied December 6 th. Vehicle License Tax Antique.

Swift county action gives residents more time to pay increased personal property taxes. As stipulated in 581-3518 of the code of virginia it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property that was used or available for use in a business and which was located in the city of richmond virginia on january 1 2021 to report such property on this return. Pay Your Parking Violation.

Meeting notifications will be sent for the following Boards and Committees. Distributors do not pay tax on items purchased for resale. Personal Property taxes are billed annually with a due date of December 5 th.

Personal Property Taxes. The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal property for 92 consecutive days or less. On or before March 31 the full bank franchise tax is assessed or 1 per 100 of net capital.

-- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on. Board of Supervisors Planning Commission Board of Zoning Appeals Wetlands. Our primary goal is to serve the citizens of Richmond County in a fair and unbiased manner by providing the highest level of customer service integrity and fiscal responsibility.

For Real Estate Tax Payments you will need your 5 digit Account Number and your Bill Number. Vagas Jackson Tax Administrator 1401 Fayetteville Rd. Real Estate and Personal Property Taxes Online Payment.

Search Valuable Data On A Property. Manufacturers do not pay tax on purchases used for production. Rockingham NC 28379 Business.

2 days agoand last updated 120 PM May 11 2022. One Simple Search Gets You a Comprehensive Richmond County Property Report. 1 day agoMay 12 2022.

Physical Address View Map 535 Telfair Street Suite 100 Augusta GA 30901. Use the map below to find your city or countys website to look up rates due dates. Call 1-888-272-9829 Press 3 for property tax and all other payments Enter Jurisdiction Code 9010 You must call the Treasurers Office to obtain the amount due.

Parking tickets can now be paid online. Understanding My Tax Bill. Vehicle License Tax Motorcycles.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. April 1 June 30 75 of the full tax amount or 75 per 100 of net capital. Tax rates differ depending on where you live.

Interest is assessed as of January 1 st at a rate of 10 per year. For Personal Property Tax Payments you will need your 5 Digit Account Number. 2 days agoThe county estimates that residents would receive a 52-cent reduction to their 2022 personal property tax rate as a result.

Car Tax Credit -PPTR. Local campaign to help with mental stress. Signing up is easy simply send an e-mail to lhylancorichmondvaus asking to be included on the e-mail notification list or call the County Administrators Office at 804-333-3415.

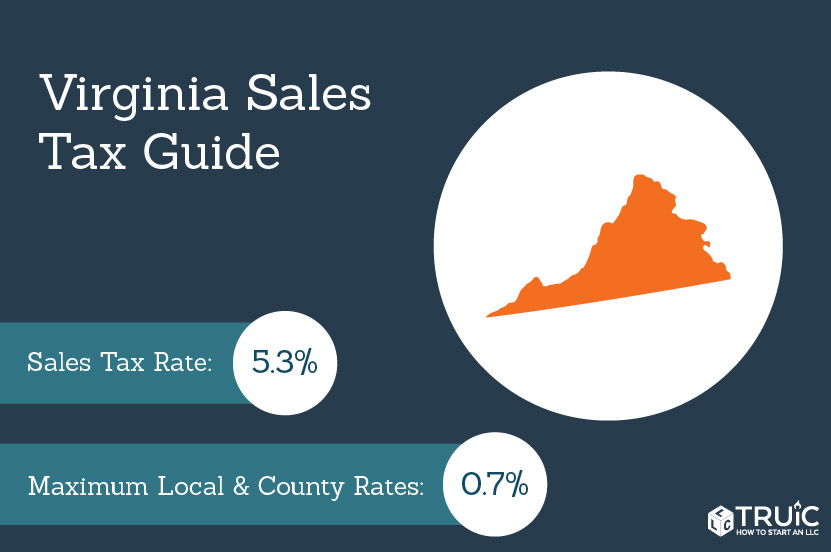

Maintain real estate owner information and county tax maps. The tax rate is 1 percent charged to the consumer at the time of rental payment. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia.

Parking Violations Online Payment. Vehicle License Tax Vehicles. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Call 804 646-7000 or send an email to the Department of Finance. Ad Get In-Depth Property Tax Data In Minutes. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates.

Such As Deeds Liens Property Tax More. Click Here to Pay Parking Ticket Online. Municipal Building Office.

Assess individual and business personal property. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800.

The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. State agency in court over right to retrieve law. Business License Search.

Yearly median tax in Richmond City. The Commissioner of the Revenue and staff. Team Papergov 1 year ago.

Finance Henrico County Virginia

Personal Property Tax And Exemptions Augusta County Va

Personal Property Tax And Exemptions Augusta County Va

Virginia Manufacturing Tax Savings Virginia Cpa Firm

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Infographic Real Estate Tips

Personal Property Tax And Exemptions Augusta County Va

Finance Henrico County Virginia

Virginia Sales Tax Small Business Guide Truic

Personal Property Tax And Exemptions Augusta County Va

News Flash Chesterfield County Va Civicengage

How Much House Can I Afford Buying First Home First Home Buyer Real Estate Tips

Pay Online Chesterfield County Va

Personal Property Vehicle Tax City Of Alexandria Va

Mortgage Brokers Vs Banks Infographic Refinance Mortgage Mortgage Marketing Mortgage Tips

The Loan Process 6 Steps Homebridge Financial Services Inc Dean Bendall Mortgage Loan Originator Mortgage Loan Originator Mortgage Loans Mortgage Payoff

.png)